As competition shifts and customer needs change, OEMs historically focused on equipment first-sales are now prioritizing aftermarket products and services.

Over the past two decades, Original Equipment Manufacturers (OEMs) have faced increasing global competition, which has changed the economics of equipment sales. Simultaneously, customers have started to expect improved parts and service levels. In many industrial sub-segments, this shift towards aftermarket service has been so strong that purchasing decisions are primarily driven by the service – not the equipment offering (e.g., elevators). Many OEMs have resisted or adapted to this change incrementally, failing to realize the revenue and profit opportunity that exists when aftermarket is prioritized.

This is changing – OEMs are evaluating if they are still leading with the right product (i.e., product vs. service) for their customers, increasingly prioritizing aftermarket services to grow and diversify their revenue streams and increase margins.

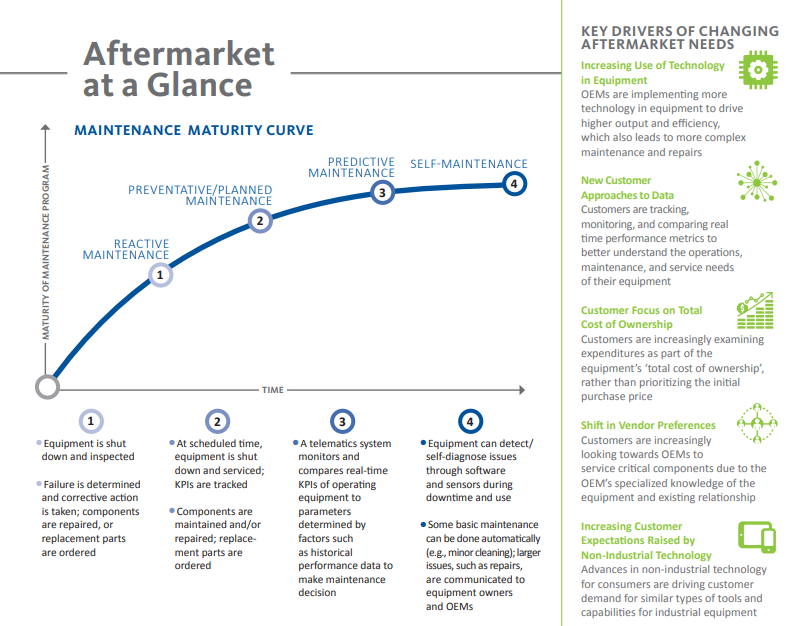

To assist in this change, Kaiser Associates developed a framework to help OEMs gauge the maturity of an aftermarket service offering relative to peers. The framework presented in the following pages will help OEMs assess their current aftermarket offerings and the steps they can take to better position themselves to meet customer needs. Kaiser also identified several opportunities that OEMs with more mature aftermarkets programs can address, creating greater value for customers and additional revenue.