The Industrial Goods and Services team recently conducted a survey of 50 machine owners in a variety of settings – factories, warehouses, mobile, and off-road – to understand their purchasing habits and how they see machine purchasing in the future. One thing is clear – machine owners see prices rising due to technological advancements and inflation, and are changing their purchasing habits accordingly. OEMs should adapt now to help machine owners manage rising prices.

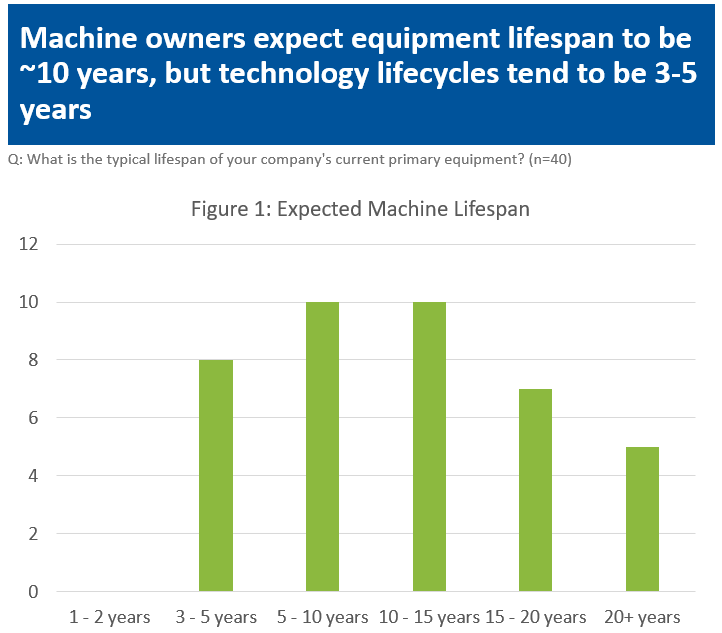

55% of machine owners expect machinery to survive over 10 years, but the technology lifecycle on the machine can be shorter at 3-5 years. This disconnect in cycles has caused friction, as machines require updates and overhauls more frequently due to technology software and hardware (e.g., sensors). Machine owners noted that this can often be a ‘hidden cost’ of equipment not considered during the purchasing process. However, machine owners also note that this issue is becoming less concerning over time, as mid-lifecycle retrofits are becoming standard to keep equipment healthy, maintain uptime, and meet current technology expectations.

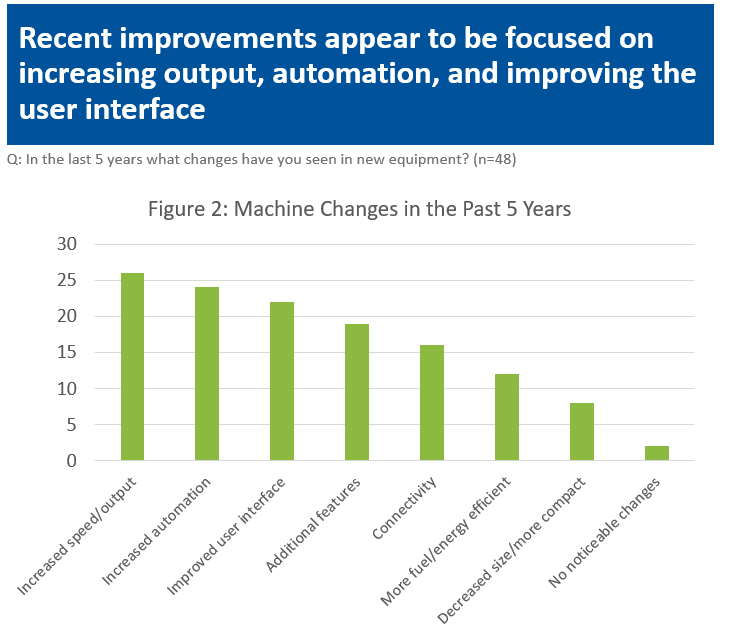

Recent machine improvements appear to be focused on increasing production/output, automation, and improving the user interfaces. The most advanced example provided was a labeling/printer machine where the OEM could increase output over-the-air. Connectivity, which was higher ranked in previous studies, has become a standard option, and is less frequently seen as a ‘recent’ change.

The machine improvements tend to be technology-driven, which is changing the way customers buy and maintain their equipment. When purchasing equipment, we historically saw mechanical features like speed, power and size follow price and durability in importance. We now see technological features and manufacturer support rising to the third and fourth most important factors when purchasing equipment. The increasing importance of manufacturer support is likely driven by the increasing technology.

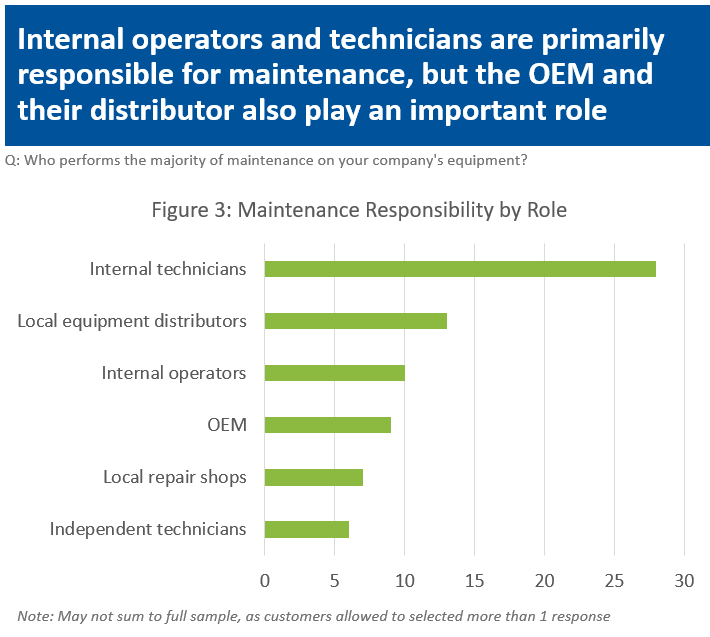

Machine owners noted that, while 93% rely on internal operators and technicians to conduct most of the machine maintenance, distributors and manufacturers are increasingly relied on for support with troubleshooting software issues or addressing technology hardware issues. In these situations, machine owners are expecting the original equipment manufacturers and/or their local distributors/dealers to quickly address their concerns.

Increases in technology have also driven up prices, with 100% of machine owners noting an increase in machinery prices over the past 5 years. 62% of machine owners surveyed noted a price increase of 11-20%, while 24% noted price increases of 6-10%. 57% of machine owners surveyed expect further price increases of 6-10% in the next 5 years.

Just as the increase in technology has changed maintenance habits and purchasing priorities, increases in price are changing the way machine owners are seeking to buy equipment, with 55% of respondents considering renting or leasing equipment in the future, vs. 30% that rent or lease equipment today.

Our findings suggest that technological advancements and increasing prices of machinery will continue to impact how machine owners purchase equipment. Leading OEMs should seek to develop strong aftermarket service programs and consider offering new supporting financial products like leases, renting, warranties, and more flexible purchase terms to maintain a competitive advantage.