Introduction

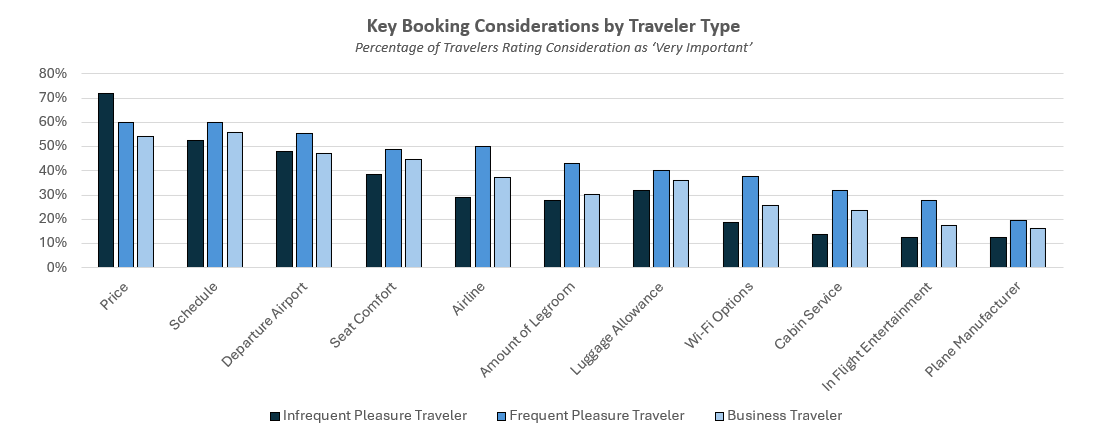

As the airline industry intensifies in competition, it is necessary to target the specific needs of different customer segments to stand out. The Aviation team at Kaiser Associates recently conducted a survey of approximately 500 American airline travelers, including infrequent leisure travelers, frequent leisure travelers, and business travelers. This article, the third in a series examining preferences in the aviation industry, provides valuable insights into the best practices for attracting and retaining each type of flyer.

Infrequent Pleasure Travelers

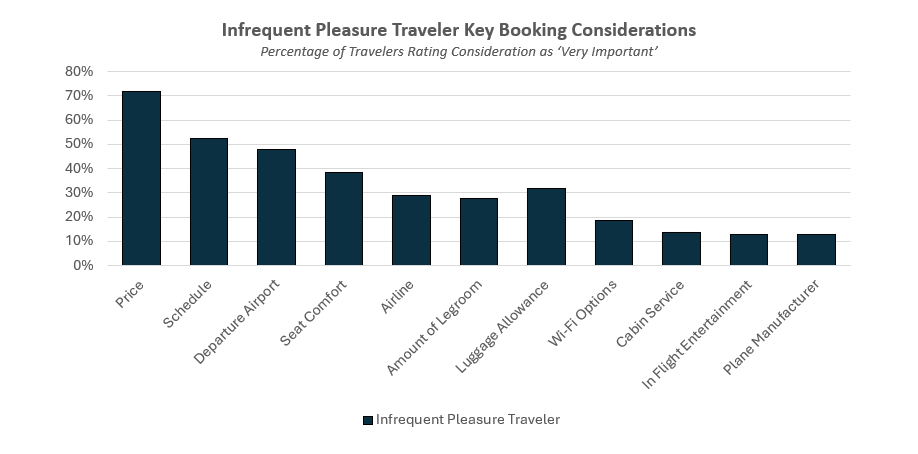

Infrequent pleasure travelers, defined as people who have flown five or fewer times in the past five years, represent a substantial portion of the annual passenger volume for airlines. These travelers, who prioritize affordability when choosing an airline, account for the highest proportion of basic economy ticket sales. Survey responses indicate that 72% of infrequent flyers consider price ‘very important.’ However, they are generally indifferent to amenities such as in-flight entertainment, Wi-Fi, and cabin service, with 13% of infrequent flyers rating in-flight entertainment as ‘very important.’ Therefore, airlines targeting infrequent pleasure travelers should focus on offering the lowest possible fares rather than providing additional amenities to justify higher costs.

Our analysis reveals that airlines and manufacturers should focus on enhancing fundamental comfort aspects like seat comfort and legroom while carefully assessing the cost-benefit ratio when introducing innovative features. The apparent passenger reluctance to pay extra for new amenities suggests that investments should be strategically targeted to meet customer willingness to pay.

Frequent Pleasure Travelers

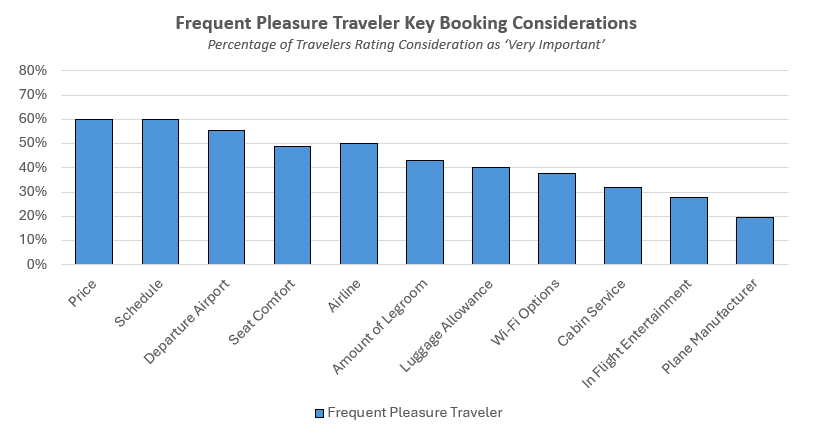

Frequent pleasure travelers, defined as those who have flown ten or more times in the past five years, constitute most airline passengers by volume. These travelers prioritize comfort and convenience when looking to book air travel. Survey data shows that 60% of frequent pleasure travelers consider the airline’s schedule to be ‘very important,’ and 56% feel similarly about the departure airport. While price remains a significant factor, with 60% ranking it as ‘very important,’ it is less critical than for infrequent pleasure travelers. Additionally, 49% of these travelers value comfortable seating, and 50% place a high importance on airlines. Airlines targeting frequent pleasure travelers should focus on designing comfortable plane cabins and offering convenient schedules while keeping costs in mind.

Business Travelers

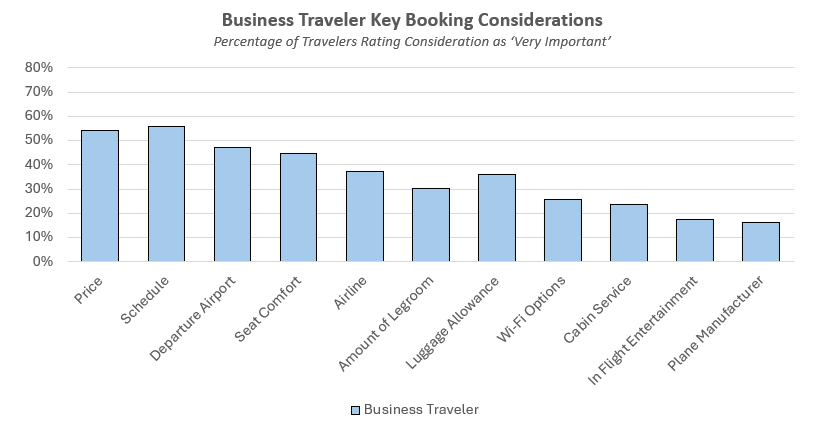

Business travelers, defined as those who have taken a business flight in the last 12 months, are the smallest group by volume but generate a significant share of airline revenue due to their higher average fare. To maximize revenue, airlines must understand and cater to their unique needs. Business travelers prioritize seat comfort and schedule when booking flights; survey data shows that 56% consider the airline’s schedule ‘very important.’ Additionally, 45% of these travelers highly value seat comfort, and a notable 37% value airlines and their respective loyalty programs. Airlines targeting this segment should offer consistent and convenient departure times, attractive loyalty programs, and comfortable seating.

Conclusion

The airline industry faces new market entrants and alternative travel options, making it crucial to target specific customer segments and use effective methods to satisfy them. Our findings indicate that traveler preferences vary widely by travel frequency and purpose, and to best differentiate themselves, airlines should identify a key customer segment and prioritize meeting their needs.

Ali Cumber, Laura Barkowski, and Jordan Manley from Kaiser’s Washington, DC, office developed the research, analysis, and insights above.

For more information on this study, our work, and our capabilities, please email us at info@kaiserassociates.com.

Kaiser’s Industrial Goods & Services Practice has broad experience across the sector, with expertise in Capital Equipment, Building Products, Packaging, Chemicals & Material and Energy, Waste & Environmental Services.