Introduction

Last week, aviation leaders gathered in Hamburg for the Aircraft Interiors Expo (AIX) to discuss future trends. Announcements ranged from minor updates like dimmable windows on the A330neo to major innovations like the MAYA seat concept with a 45” curved OLED display. But what do customers want in aircraft interiors, and how much willingness is there to pay for extras?

Key Interior Considerations

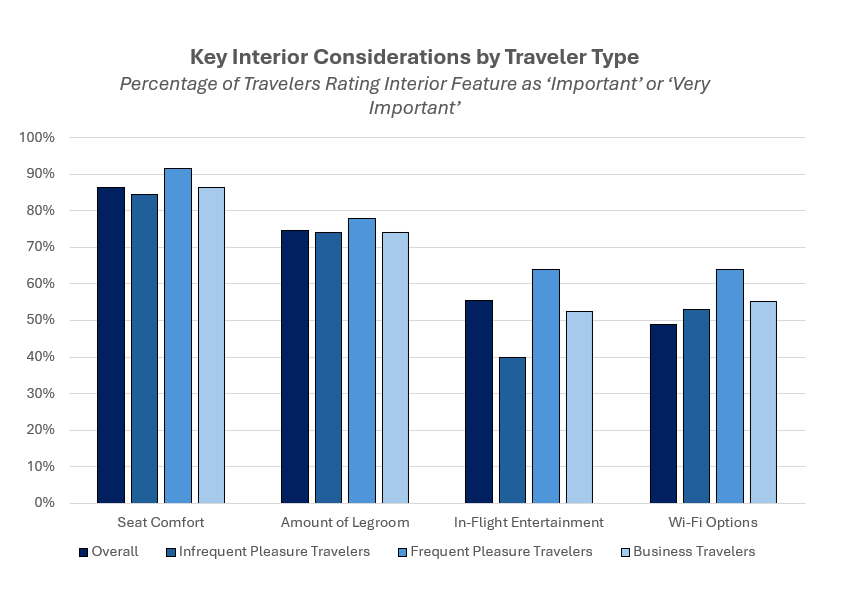

Regarding plane interiors, 89% of survey respondents rate seat comfort as ‘Important’ or ‘Very Important,’ making it the top priority for travelers. This concern is especially pronounced among frequent pleasure travelers, who value seat comfort more than any other passenger. However, seat comfort remains a significant consideration across all categories of travelers. Following seat comfort, legroom is the next most crucial factor, with 75% of respondents rating it as ‘Important’ or ‘Very Important.’ Adequate legroom contributes significantly to passengers’ overall comfort and satisfaction during their flight.

In contrast, interior electronics, such as In-Flight Entertainment (IFE) and Wi-Fi options, are less critical to travelers. Only 56% of survey respondents consider IFE to be ‘Important’ or ‘Very Important,’ while 49% rate Wi-Fi options similarly. Despite their lower overall importance, these electronic amenities are notably more valued by pleasure travelers compared to other passenger types, highlighting a potential area for differentiation among airlines targeting leisure markets.

Extras

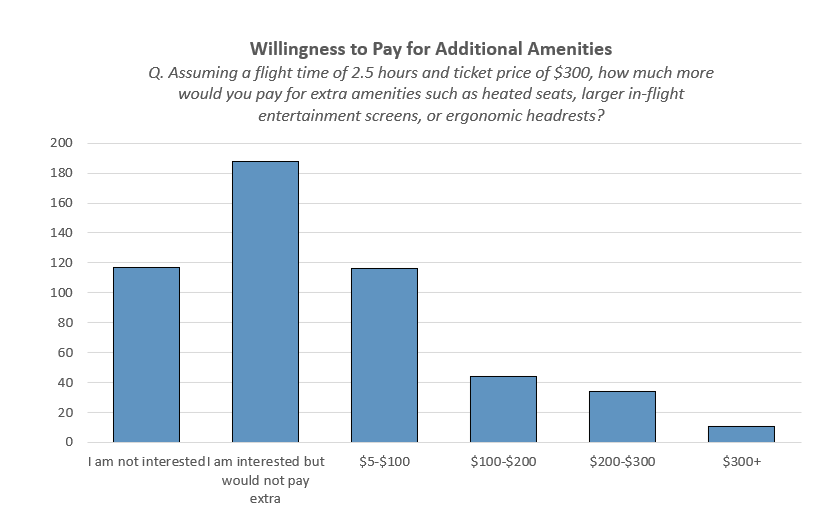

While we know how customers feel about standard aircraft interiors, what about additional innovative options? Our survey asked customers, “assuming a flight time of 2.5 hours and a ticket price of $300, how much more they would pay for extra amenities such as heated seats, larger in-flight entertainment screens, or ergonomic headrests.”

23% of respondents were not interested in additional amenities, indicating a preference for the status quo or a lack of awareness of new interior features. Meanwhile, 37% expressed interest in these features but were unwilling to pay extra, suggesting that while the ideas are attractive, they do not justify higher costs for many passengers.

These results indicate that while innovative airline features like advanced seating options and upgraded entertainment systems are appealing in theory, most passengers are either uninterested or unwilling to incur additional costs. Airlines considering introducing such features might need to carefully evaluate whether the potential benefits justify the investment, given passengers’ apparent reluctance to pay extra for these enhancements.

Conclusion

Our analysis reveals that airlines and manufacturers should focus on enhancing fundamental comfort aspects like seat comfort and legroom while carefully assessing the cost-benefit ratio when introducing innovative features. The apparent passenger reluctance to pay extra for new amenities suggests that investments should be strategically targeted to meet customer willingness to pay.

The research, analysis, and insights above were developed by Ali Cumber, Laura Barkowski, and Jordan Manley from Kaiser’s Washington, DC office. For more information on this study, our work and capabilities, please reach out to our team or email info@kaiserassociates.com.