Voice of Customer interviews are a critical diligence tool that most firms execute by following commonly accepted best practices:

- Creating a truly representative sample with consideration to customer size, strategic importance, geographic representation, and product/solution coverage

- Selecting the customer sample randomly to avoid bias (and uncover any problem customers that the target might be incented to exclude from the interviews)

- Identifying the right contacts to recruit and interview at each customer (mix of decision makers and users)

- Deploying effective and creative sourcing approaches to recruit and successfully interview those contacts

- Designing interview guides that are focused on the highest priority issues, tailored specifically to the interviewee, and effective at engaging customers

These steps are the foundation of any good VoC interview effort. However, nuanced insights do not necessarily come through to the investor just by reading a summary report or even transcripts of the VoC interviews. Ultimately, the standard approach falls short in delivering the very nuggets of insight that investors are so keenly interested in discovering.

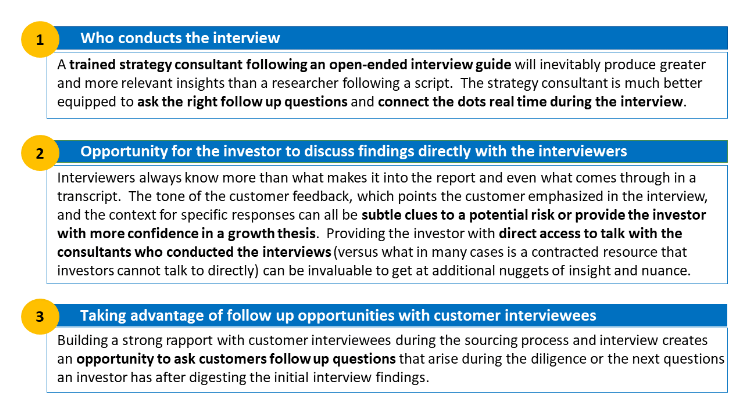

At Kaiser, we go beyond the standard approach to uncover the subtle customer insights that most VoC interview efforts miss. We help investors “read between the lines” of the VoC interview in three specific ways:

Developing and analyzing VoC findings is an intricate application of science and art. Asking the right questions and following up with the most relevant next questions in real time is an art powered by quick thinking on your feet and perfected by daily practice. Fluency in translating detailed nuance into a big picture implication is an invaluable asset to a PE investor. Kaiser’s institutionalized knowledge to deliver such nuance is a unique capability that generates a deeper fact-base, greater certainty, and decision-making confidence.

Looking to capture VoC insights during the diligence process?

Kaiser’s Voice of Customer research can cover a broad range of topics and themes, with the bespoke approach designed to answer your core investment questions.