While the global pandemic has undoubtedly led to a short-term cash crisis among consumers and businesses, it has also accelerated the development of digital financial services. Financial services customers have long demanded a more seamless and digitally native user experience for payments, but COVID-19 is forcing financial institutions to catch-up as well as recognize that a ‘One Size Fits All’ approach can no longer remain tenable.

Understanding the Changing Landscape

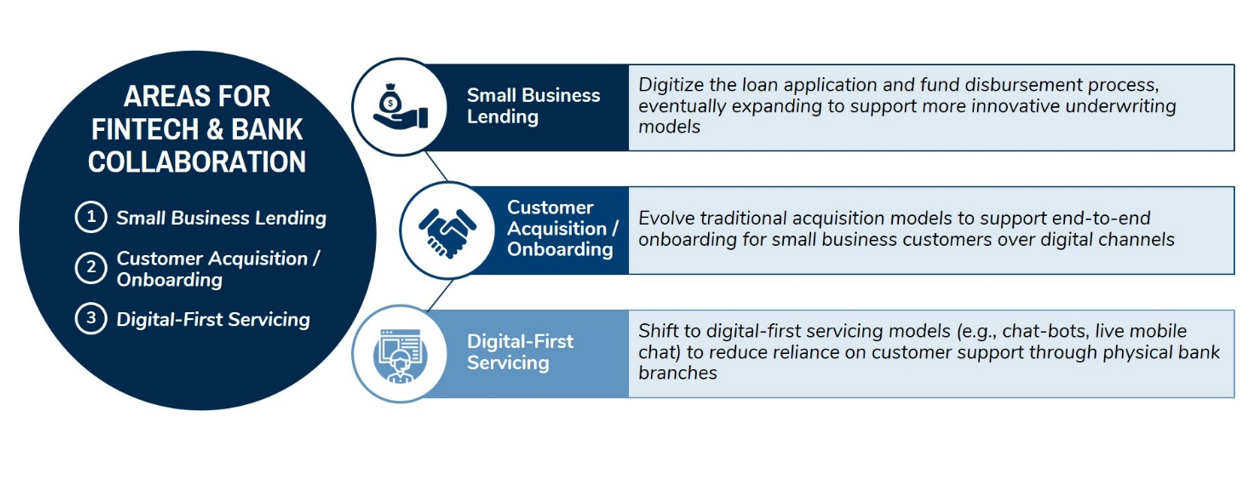

Kaiser’s Financial Services and Payments practice recognizes that these changing dynamics will foster unique partnership opportunities between legacy financial institutions and Fintech firms. We expect this to include, but not be limited to, the key innovation areas below.

Small Business Lending

Though disruptors such as Kabbage and Bluevine have offered digitally native business models for small business (SB) lending, traditional banks are beginning to prioritize similar developments and leverage Fintech partners for depl

oyment. For instance, fintech firm MX recently partnered with the Central Pacific Bank of Hawaii to configure a business loan application portal. In the mid-/long-term, Kaiser recognizes opportunities for these types of partnerships to expand as banks aim to deploy more robust approaches to credit scoring, interest calculations, and other dimensions of the loan process for small businesses.

Customer Acquisition / Onboarding

In one recent Kaiser study, we found that large domestic issuers across several large, global markets were anxious to expand end-to-end digital onboarding for the small business segment. Several issuers cited best-in-class models such as US-based fintech Brex, which deploys an innovative underwriting model to provide commercial payment solutions to technology entrepreneurs and/

or startups. Furthermore, issuers recognized that third-party development partners will be key for rapid scaling of digital onboarding models, particularly as COVID-19 limits the efficacy of physical branch networks for acquisition.

Digital-First Servicing

The global pandemic will not only place a temporary hold on analog servicing models, but also permanently reshape the financial services industry as consumers and businesses clamor for instant access to support at the ‘ti

me of need.’ US payment processor Jack Henry recognized this trend several years ago, acquiring mobile development startup Banno in 2014. Since then, Banno has become the backbone for Jack Henry’s personal banking suite, with a ‘Conversations’ module that enables bank partners to deploy live chat capabilities within the banking app. Kaiser expects digitally native service models to increasingly become a market standard, particularly as European challenger banks (e.g., Revolut, Monzo) expand to the US with these customer engagement strategies already in place.