The payments industry in recent years has been marked by a dramatic shift away from POS payments towards the world of e-commerce with card-not-present transactions becoming increasingly common. This trend has only been exacerbated by the COVID-19 pandemic. With retail brick-and-mortar locations still closed in many parts of the world, consumer purchasing has shifted heavily towards e-commerce.

Even as lockdowns across the United States, Europe, and Asia lift and retail stores begin to reopen, the trend towards higher e-commerce engagement will likely continue for many merchants. While the move towards e-commerce presents many opportunities for businesses, merchants face significant challenges as they pivot to online payments.

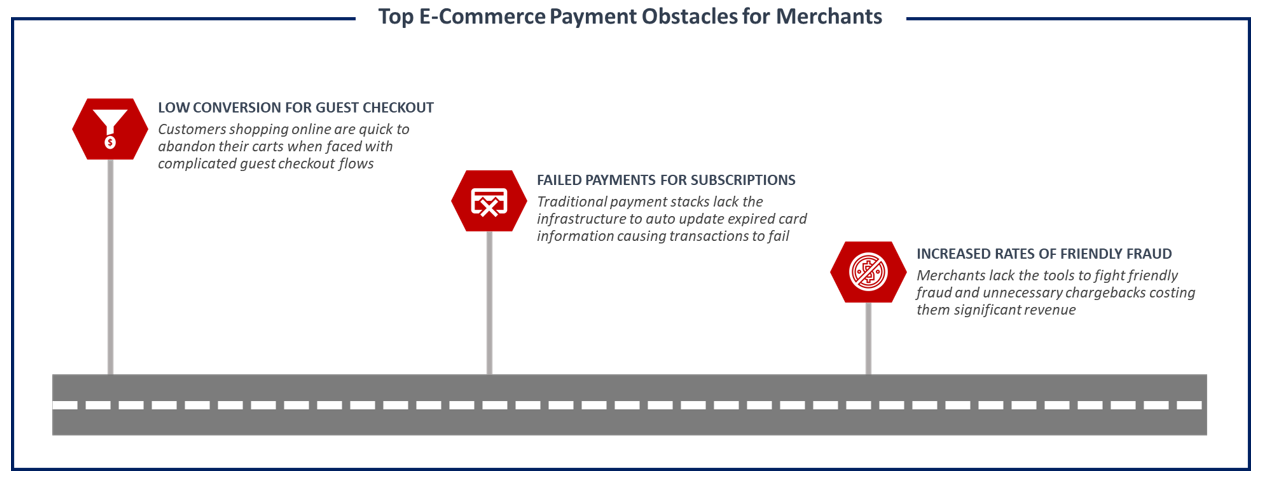

Three primary obstacles emerge for merchants accepting e-commerce payments in the wake of COVID-19 and beyond.

Obstacle 1: Low Conversion for Guest Checkout

Customers shopping online are quick to abandon their carts when faced with complicated guest checkout flows

Even as the e-commerce landscape evolves, most online sales continue to occur via guest checkout rather than card-on-file. However, payment via guest checkout takes significantly longer than card-on-file as customers must input cardholder information on multiple screens. This leads to high rates of cart abandonment and considerably lower purchase conversion for guest checkout then for card-on-file.

These challenges are felt most greatly by SMBs and traditional brick-and-mortar retailers just now launching e-commerce sales. These merchants often run their checkout pages through commerce enablers, PSPs, or payment facilitators. In these cases, customers may be navigated away from the merchant’s website to a third-party page for checkout. Inconsistencies in the UX between these webpages can raise customer concerns about fraud and drive even greater cart abandonment.

Given these challenges, merchants are increasingly turning to digital wallets and express payment methods to reduce the need for manual data entry during online checkout. Wallets such as Apple Pay have been building traction amongst merchants in recent years and are well positioned to expand in the wake of COVID-19. Additionally, the release of EMVCo’s Secure Remote Commerce offering suggests that card networks are also looking to help merchants address checkout friction.

Obstacle 2: Failed Payments for Subscriptions

Traditional payment stacks lack the infrastructure to auto update expired card information, causing transactions to fail

As consumer purchasing habits have shifted towards e-commerce, subscription-based services have grown rapidly over the last decade. Subscription platforms are now available for most major industries, perhaps most notably in entertainment. While leaders in the space have historically been digital services providers (e.g., Netflix, Spotify), the rise of social distancing has positioned the economy to shift towards increased reliance on subscription for physical goods as well (e.g., groceries, apparel).

Embracing subscription models presents a considerable new financial opportunity for merchants; however, integrating and managing recurring payments is often difficult for businesses. Traditional payment stack solutions for e-commerce are often not optimized for recurring payments. Even as more providers integrate these capabilities into their offerings, transactions often fall through the cracks due to outdated card information, and merchants struggle to obtain high authorization rates on subscription purchases.

Fintech providers are increasingly entering the market to meet the needs of subscription companies. These players (e.g., Recurly, Churnbuster) leverage machine learning to optimize card acceptance for subscription payments, and many offer the ability to auto update expired card information. While these services are becoming heavily used by leading subscription providers, SMBs and less sophisticated merchants may lack awareness of these companies and their value.

Obstacle 3: Increased Rates of Friendly Fraud

Merchants lack the tools necessary to fight friendly fraud and unnecessary chargebacks, costing them significant revenue

As consumers continue to avoid going into brick-and-mortar stores throughout the remainder of the COVID-19 pandemic, high card-not-present transaction volume has forced merchants to contend with rising chargeback rates. While many chargebacks result from fraudulent e-commerce transactions, a significant portion stem from friendly fraud.

Despite the known prevalence of friendly fraud in e-commerce, merchants rarely take steps to fight these chargebacks given the difficulty in doing so. Issuers rarely provide merchants with information on the reason for chargebacks, complicating effort to investigate cases. As such, the cost of challenging chargebacks is often seen as not worth it. This issue has been compounded by the COVID-19 crisis as reduced consumer spending has left many merchants short on cash.

Some merchants have begun turning to third-party providers such as Ethoca and Verifi for chargeback support; however, the space remains in its infancy. Early players are enabling increased data sharing between card issuers and e-commerce merchants, which can both prevent friendly fraud and help merchants investigate unnecessary chargebacks that do occur.

Opportunities for Payments Players

As COVID-19 continues to accelerate the economy’s shift towards e-commerce, addressing friction for online payment will become increasingly important for merchants. While third-party providers are already helping to solve these challenges for large businesses and digital-first merchants, SMBs and historically brick-and-mortar retailers may need additional support. Commerce enablers and aggregators (e.g., PSPs, payment facilitators) are in a unique position to help address challenges for these merchants by connecting them to e-wallets, express payments platforms, and fintechs.