With an estimated 400 million tonnes¹ of plastic waste generated each year, consumer pressure on brand owners to help address the waste is increasing. We recently surveyed brand owners to understand how they view the role of plastic suppliers (e.g., resin suppliers and converters) in their plastic waste reduction efforts. One thing is clear – brand owners would like to see suppliers do more to help them meet plastic waste reduction goals.

The Industrial Goods and Services team recently conducted a survey of 77 brand owners across multiple consumer (B2C) and industrial (B2B) sectors to understand how they view the role of suppliers (e.g., resin suppliers and converters) in their plastic waste reduction efforts. We asked brand owners how they plan to meet plastic waste reduction targets, if applicable, and their view on various plastic waste reduction methodologies.

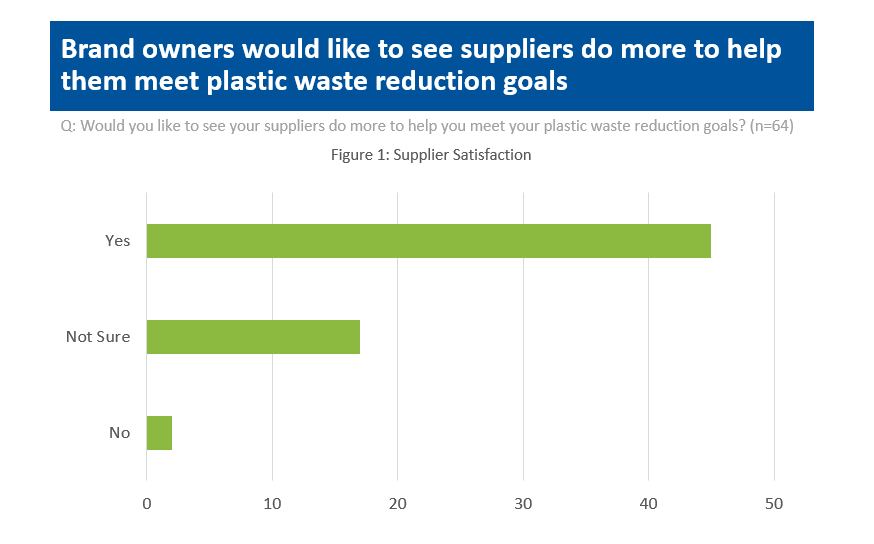

Over the past decade or so, external forces have increased awareness of plastic usage recyclability, and waste of consumer and B2B products globally shifting the focus from plastic reduction to plastic waste reduction. While efforts are ongoing across the value chain in support of this initiative, 71% of brand owners would like to see suppliers do more to help them meet plastic waste reduction goals. An additional 27% were unsure of the supplier role, indicating an opportunity for suppliers to provide additional education to brand owners on how they can help reduce plastic waste.

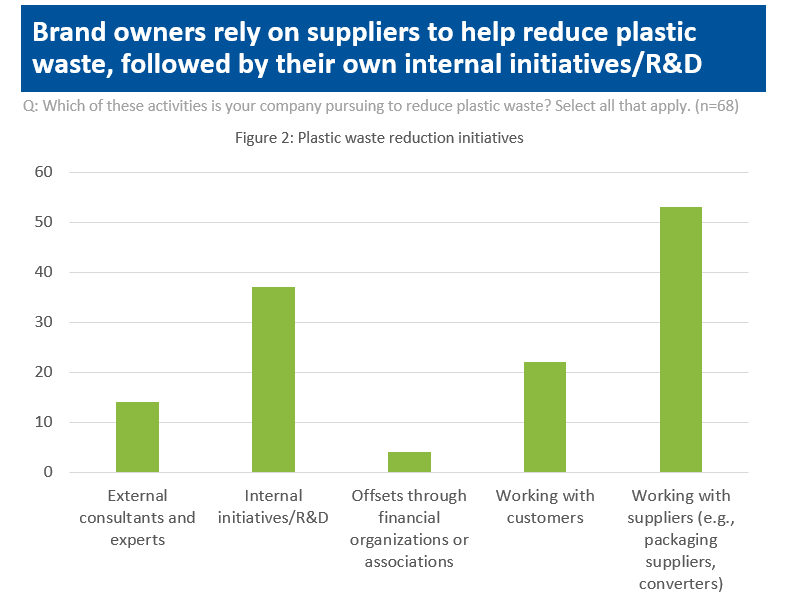

Brand owners view suppliers as their top weapon in the fight against plastic pollution. In instances where customers are leveraging their supplier relationships to improve plastic waste reduction efforts, 57% of respondents claim these are driven by the brand owner versus initiated by suppliers. Brand owners also noted EU suppliers tend to have more initiative relative to US suppliers, which could be explained by the number of bans on single-use plastic products across the EU. Ultimately, our research showed a strong desire from brand owners for suppliers to help more, and they are pushing their suppliers accordingly. Suppliers can differentiate by proactively bringing their technologies and capabilities to the brand owners.

Internal initiatives/R&D rank second to suppliers as the most common initiative to reduce plastic waste, however, 46% of respondents are not sure these measures will be sufficient in the fight against plastic waste. Internal efforts for brand owners to innovate and create new solutions are bound by the performance capabilities defined by the resin suppliers and plastic converters upstream of the value chain.

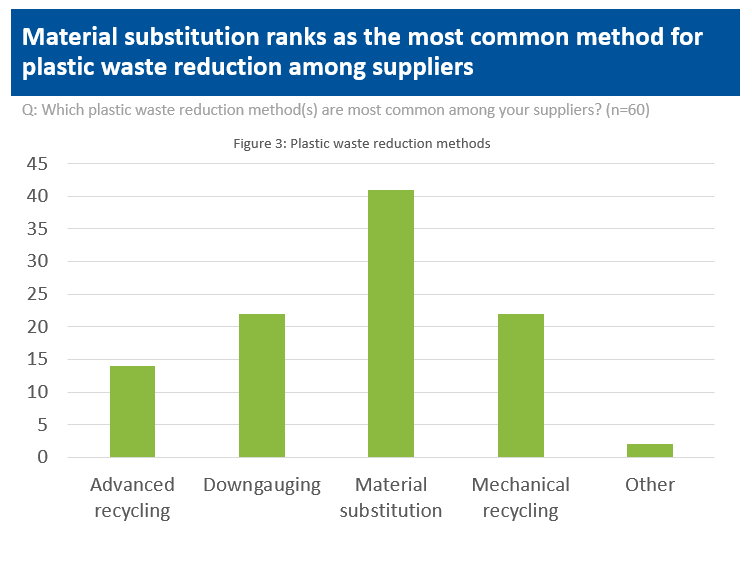

When assessing the various plastic waste reduction methods across the market, material substitution comes out on top as the most common solution, particularly among food and beverage brand owners, but was also noted as the second most expensive method (second to advanced recycling). Solutions with less plastic/containing more recycled content/more environmentally friendly tend to come with a premium creating a barrier for adoption up the value chain. Despite the growing public perception against single-use plastics, brand owners assert 52% of consumers are not willing to pay a premium for these alternatives, which is estimated to be 15%.

While advanced recycling has gained popularity among major resin suppliers, it continues to be capital-intensive, with unique challenges in feedstock security. Building the infrastructure to ensure a steady supply of recyclable material reaches all advanced recycling operations appears to be the primary obstacle. With only 9%² of plastic waste being recycled today, advanced recycling is viewed as a complement to traditional mechanical recycling methods as it would allow previously difficult to recycle plastics to have a new life.

In the eyes of brand owners, suppliers are simply not doing enough to help them meet consumer demands and regulatory changes. The reality is that efforts to reduce plastic waste require all parties along the value chain, from resin suppliers all the way to the brand owners, to take on an active, more proactive role.